All Categories

Featured

Table of Contents

For lots of people, the greatest issue with the limitless financial concept is that preliminary hit to very early liquidity triggered by the costs. Although this disadvantage of limitless banking can be decreased significantly with appropriate policy design, the very first years will constantly be the most awful years with any Whole Life plan.

That said, there are specific limitless banking life insurance policy policies designed primarily for high early money worth (HECV) of over 90% in the very first year. The long-term efficiency will frequently considerably delay the best-performing Infinite Banking life insurance policies. Having access to that added 4 numbers in the first couple of years may come at the price of 6-figures later on.

You really get some significant lasting advantages that aid you recover these early expenses and after that some. We discover that this prevented early liquidity trouble with limitless banking is extra psychological than anything else when completely checked out. If they definitely needed every cent of the money missing from their boundless financial life insurance plan in the initial couple of years.

Tag: boundless financial concept In this episode, I discuss financial resources with Mary Jo Irmen who shows the Infinite Banking Principle. This topic might be debatable, however I want to get diverse views on the show and find out about various strategies for farm financial monitoring. A few of you may concur and others will not, but Mary Jo brings an actually... With the rise of TikTok as an information-sharing system, economic advice and techniques have discovered a novel method of dispersing. One such approach that has actually been making the rounds is the boundless banking idea, or IBC for short, gathering recommendations from celebrities like rap artist Waka Flocka Fire. While the technique is presently popular, its roots trace back to the 1980s when economist Nelson Nash introduced it to the globe.

Within these policies, the cash money value expands based upon a rate established by the insurance company. Once a considerable cash value builds up, insurance policy holders can obtain a cash value financing. These loans vary from traditional ones, with life insurance policy working as security, meaning one can lose their protection if loaning exceedingly without appropriate cash money worth to sustain the insurance policy prices.

And while the allure of these plans is apparent, there are inherent restrictions and threats, requiring persistent money value surveillance. The approach's authenticity isn't black and white. For high-net-worth people or entrepreneur, especially those making use of methods like company-owned life insurance coverage (COLI), the advantages of tax breaks and compound development can be appealing.

Banking On Yourself

The attraction of boundless banking does not negate its challenges: Expense: The fundamental demand, a long-term life insurance policy policy, is costlier than its term counterparts. Eligibility: Not everyone receives whole life insurance due to rigorous underwriting processes that can exclude those with details health and wellness or way of life conditions. Complexity and danger: The intricate nature of IBC, coupled with its dangers, might deter numerous, particularly when simpler and much less high-risk choices are offered.

Assigning around 10% of your month-to-month income to the policy is simply not practical for most individuals. Utilizing life insurance coverage as an investment and liquidity source requires discipline and monitoring of policy cash worth. Get in touch with a monetary advisor to determine if unlimited financial straightens with your top priorities. Part of what you review below is just a reiteration of what has already been stated over.

So prior to you obtain into a scenario you're not gotten ready for, know the following first: Although the concept is frequently marketed thus, you're not in fact taking a car loan from on your own. If that held true, you wouldn't have to repay it. Rather, you're borrowing from the insurance coverage firm and need to settle it with passion.

Some social media messages recommend making use of cash money value from entire life insurance policy to pay down credit scores card financial debt. When you pay back the lending, a section of that interest goes to the insurance coverage company.

For the initial several years, you'll be paying off the commission. This makes it extremely challenging for your plan to collect worth during this time. Unless you can pay for to pay a few to several hundred dollars for the next years or even more, IBC won't work for you.

Infinite Banking Simplified

Not everyone should count entirely on themselves for monetary safety and security. If you require life insurance, below are some important suggestions to think about: Take into consideration term life insurance policy. These policies give insurance coverage during years with significant monetary commitments, like home mortgages, pupil financings, or when looking after young kids. See to it to search for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Typeface Call "Montserrat". This Typeface Software application is licensed under the SIL Open Up Font Style Certificate, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Style Call "Montserrat". This Font Software program is accredited under the SIL Open Typeface Permit, Version 1.1.Miss to primary content

Nelson Nash Infinite Banking

As a certified public accountant focusing on realty investing, I have actually brushed shoulders with the "Infinite Banking Concept" (IBC) much more times than I can count. I have actually even interviewed professionals on the subject. The primary draw, apart from the noticeable life insurance policy advantages, was constantly the concept of developing money value within an irreversible life insurance policy plan and borrowing against it.

Certain, that makes good sense. But truthfully, I always thought that money would certainly be better spent straight on investments instead of funneling it through a life insurance policy plan Till I discovered exactly how IBC can be integrated with an Irrevocable Life Insurance Coverage Depend On (ILIT) to produce generational wealth. Let's start with the basics.

Bioshock Infinite Bank Of Columbia

When you obtain against your plan's money worth, there's no set settlement timetable, offering you the flexibility to manage the loan on your terms. The cash worth continues to expand based on the policy's guarantees and returns. This configuration allows you to gain access to liquidity without disrupting the long-term development of your policy, supplied that the lending and interest are handled intelligently.

The process continues with future generations. As grandchildren are birthed and expand up, the ILIT can purchase life insurance plans on their lives. The depend on then builds up numerous plans, each with growing cash values and fatality benefits. With these policies in position, the ILIT properly ends up being a "Family members Bank." Relative can take car loans from the ILIT, making use of the cash worth of the plans to money investments, begin businesses, or cover significant expenses.

An important element of managing this Family members Financial institution is using the HEMS requirement, which means "Wellness, Education, Upkeep, or Support." This guideline is often included in depend on arrangements to direct the trustee on just how they can disperse funds to beneficiaries. By adhering to the HEMS criterion, the trust makes sure that distributions are made for important demands and long-lasting support, securing the depend on's properties while still attending to relative.

Raised Adaptability: Unlike rigid small business loan, you regulate the payment terms when borrowing from your very own policy. This permits you to framework repayments in a manner that straightens with your business cash money flow. whole life insurance infinite banking. Improved Capital: By funding overhead with plan lendings, you can potentially maximize cash that would certainly otherwise be bound in typical loan payments or equipment leases

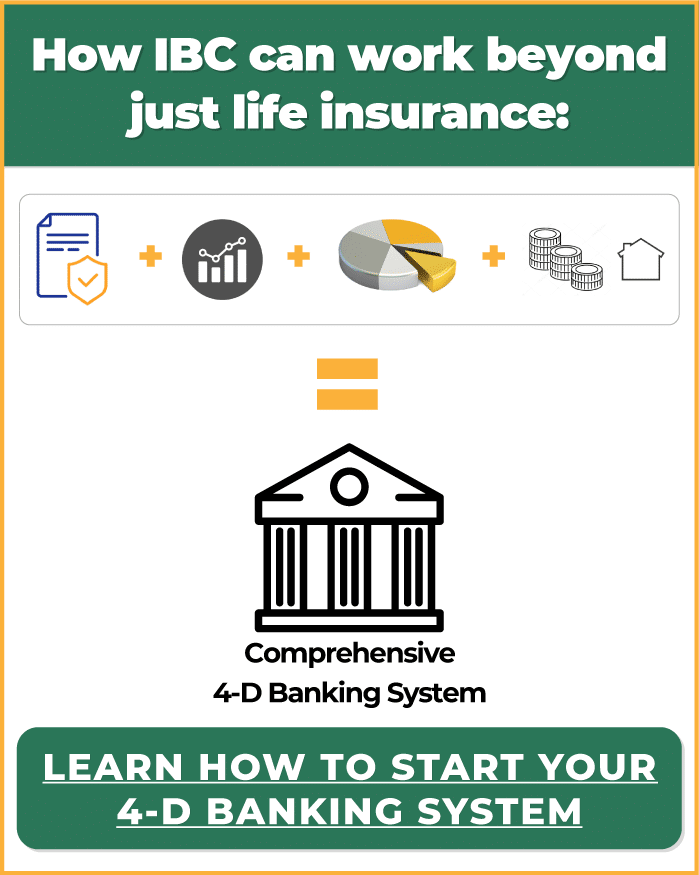

He has the very same tools, however has additionally constructed additional cash worth in his policy and got tax obligation advantages. Plus, he now has $50,000 available in his plan to make use of for future possibilities or expenditures., it's vital to watch it as more than simply life insurance coverage.

Non Direct Recognition Life Insurance Companies

It's about creating a flexible financing system that offers you control and supplies multiple benefits. When made use of strategically, it can match various other investments and organization strategies. If you're interested by the potential of the Infinite Banking Concept for your organization, here are some steps to think about: Enlighten Yourself: Dive deeper right into the concept with trustworthy books, workshops, or consultations with experienced experts.

Latest Posts

'Be Your Own Bank' Mantra More Relevant Than Ever

My Own Bank

Become Your Own Banker Whole Life Insurance