All Categories

Featured

Table of Contents

So it is not mosting likely to be some magic path to wealth. It will certainly help you make a little bit a lot more on your cash long-term. Obviously, there are various other benefits to any kind of whole life insurance plan. As an example, there is the survivor benefit. While you are attempting to minimize the ratio of premium to survivor benefit, you can not have a plan with no fatality benefit.

Some people marketing these plans suggest that you are not interrupting compound rate of interest if you obtain from your plan instead than take out from your financial institution account. The money you borrow out earns absolutely nothing (at bestif you do not have a clean car loan, it may also be costing you).

A lot of the individuals that purchase right into this concept additionally buy into conspiracy theory theories about the world, its federal governments, and its banking system. IB/BOY/LEAP is positioned as a means to somehow avoid the globe's monetary system as if the globe's biggest insurance coverage business were not part of its monetary system.

It is invested in the basic fund of the insurance business, which largely invests in bonds such as US treasury bonds. You obtain a bit greater rate of interest price on your money (after the first few years) and perhaps some asset protection. Like your investments, your life insurance should be dull.

The Infinite Banking System

It appears like the name of this concept modifications when a month. You may have heard it referred to as a continuous wealth technique, family members banking, or circle of riches. No matter what name it's called, boundless financial is pitched as a secret means to build riches that just rich people learn about.

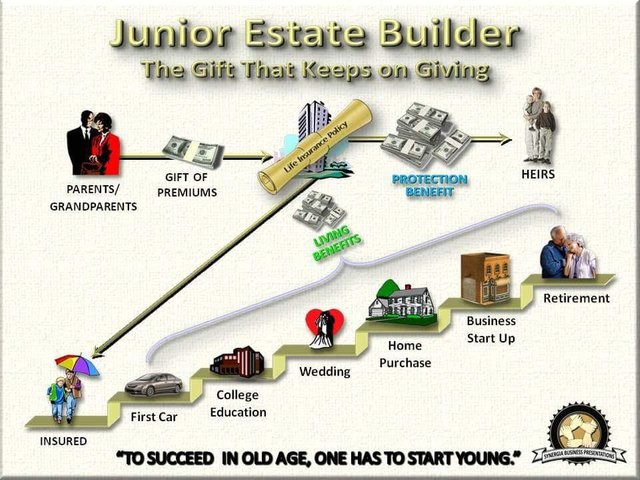

You, the insurance policy holder, put cash into an entire life insurance plan via paying costs and acquiring paid-up additions.

A Life Infinite

The entire principle of "financial on yourself" only works due to the fact that you can "bank" on yourself by taking finances from the policy (the arrow in the graph over going from whole life insurance policy back to the policyholder). There are two different kinds of fundings the insurance provider may supply, either straight recognition or non-direct acknowledgment.

One function called "clean financings" establishes the rates of interest on car loans to the very same rate as the reward rate. This suggests you can obtain from the policy without paying passion or receiving passion on the quantity you borrow. The draw of infinite banking is a returns rate of interest and assured minimal rate of return.

The disadvantages of limitless financial are commonly forgotten or otherwise mentioned in all (much of the info offered about this principle is from insurance policy agents, which might be a little biased). Only the money value is expanding at the reward price. You likewise have to pay for the expense of insurance coverage, charges, and costs.

Every long-term life insurance plan is various, but it's clear somebody's total return on every dollar invested on an insurance product might not be anywhere close to the dividend price for the plan.

What Is Infinite Banking Life Insurance

To offer a really basic and hypothetical example, let's think a person has the ability to make 3%, typically, for every buck they spend on an "unlimited banking" insurance policy item (nevertheless costs and costs). This is double the approximated return of entire life insurance coverage from Customer News of 1.5%. If we assume those dollars would certainly be subject to 50% in tax obligations amount to if not in the insurance policy product, the tax-adjusted price of return can be 4.5%.

We think more than ordinary returns overall life item and a really high tax obligation rate on bucks not take into the policy (which makes the insurance policy product look much better). The reality for many individuals might be even worse. This fades in contrast to the long-term return of the S&P 500 of over 10%.

Cut Bank Schools Infinite Campus

At the end of the day you are buying an insurance coverage item. We enjoy the security that insurance provides, which can be obtained much less expensively from a low-cost term life insurance plan. Unsettled car loans from the policy may additionally decrease your death benefit, decreasing an additional level of security in the policy.

The concept just works when you not just pay the significant premiums, yet make use of added cash to purchase paid-up additions. The possibility expense of all of those bucks is significant exceptionally so when you can instead be purchasing a Roth Individual Retirement Account, HSA, or 401(k). Also when compared to a taxable financial investment account or also an interest-bearing account, unlimited banking may not supply comparable returns (compared to investing) and equivalent liquidity, access, and low/no cost structure (compared to a high-yield interest-bearing accounts).

When it comes to financial planning, entire life insurance coverage usually stands out as a popular alternative. While the concept could seem appealing, it's critical to dig deeper to recognize what this actually suggests and why viewing whole life insurance in this way can be deceptive.

The concept of "being your own bank" is appealing because it suggests a high level of control over your finances. This control can be imaginary. Insurer have the utmost say in exactly how your plan is handled, including the terms of the financings and the prices of return on your money worth.

If you're thinking about whole life insurance coverage, it's vital to see it in a broader context. Entire life insurance policy can be a beneficial device for estate preparation, offering a guaranteed survivor benefit to your beneficiaries and potentially supplying tax advantages. It can also be a forced savings lorry for those that struggle to conserve cash continually.

How Infinite Banking Works

It's a type of insurance policy with a savings element. While it can offer stable, low-risk growth of cash money value, the returns are generally reduced than what you may accomplish through various other investment lorries. Before delving into whole life insurance coverage with the concept of limitless financial in mind, take the time to consider your financial objectives, threat tolerance, and the full range of monetary items available to you.

Unlimited banking is not an economic panacea. While it can function in particular situations, it's not without threats, and it needs a considerable dedication and recognizing to take care of successfully. By identifying the prospective challenges and understanding truth nature of entire life insurance policy, you'll be better equipped to make an informed choice that sustains your monetary health.

This book will show you exactly how to establish a financial plan and how to utilize the financial policy to purchase realty.

Limitless financial is not a services or product used by a certain institution. Unlimited banking is a method in which you get a life insurance policy plan that builds up interest-earning money worth and obtain lendings versus it, "borrowing from on your own" as a resource of resources. Then ultimately repay the finance and begin the cycle throughout once again.

Pay policy premiums, a part of which constructs cash worth. Take a lending out against the policy's money value, tax-free. If you utilize this concept as meant, you're taking cash out of your life insurance plan to buy whatever you would certainly require for the remainder of your life.

Latest Posts

'Be Your Own Bank' Mantra More Relevant Than Ever

My Own Bank

Become Your Own Banker Whole Life Insurance