All Categories

Featured

Table of Contents

The are whole life insurance policy and global life insurance coverage. expands money value at an ensured rates of interest and additionally with non-guaranteed returns. grows money worth at a dealt with or variable rate, depending on the insurance firm and policy terms. The cash money value is not added to the survivor benefit. Cash worth is a function you make the most of while to life.

After ten years, the money worth has actually grown to roughly $150,000. He obtains a tax-free lending of $50,000 to start an organization with his brother. The policy funding interest rate is 6%. He pays off the lending over the next 5 years. Going this route, the passion he pays goes back right into his policy's money worth rather of a financial organization.

Infinity Banca

The idea of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a finance expert and follower of the Austrian institution of economics, which supports that the worth of goods aren't clearly the outcome of typical financial structures like supply and demand. Instead, people value money and products in a different way based upon their financial condition and requirements.

Among the challenges of typical banking, according to Nash, was high-interest prices on financings. Way too many people, himself included, obtained into financial trouble as a result of dependence on banking institutions. Long as financial institutions established the passion rates and funding terms, individuals really did not have control over their own wide range. Becoming your own banker, Nash determined, would certainly put you in control over your financial future.

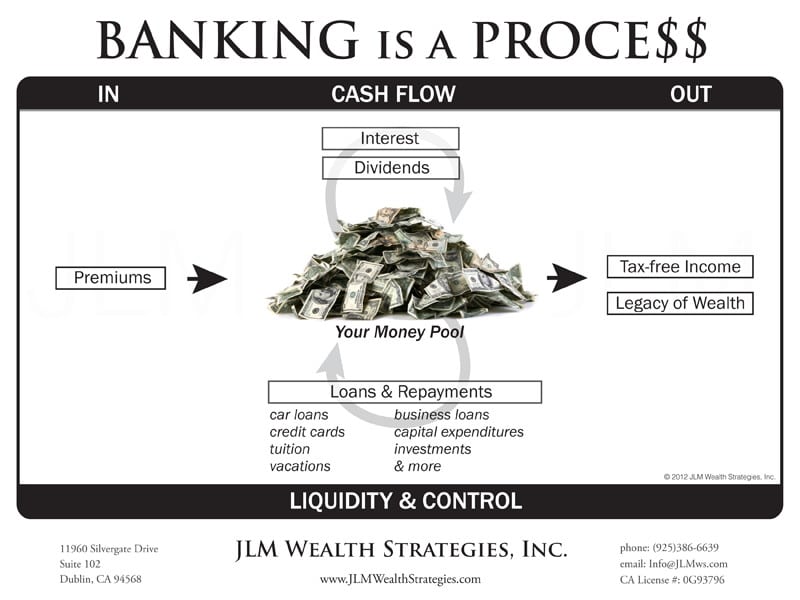

Infinite Banking requires you to own your monetary future. For goal-oriented individuals, it can be the best financial device ever before. Here are the advantages of Infinite Financial: Arguably the solitary most helpful aspect of Infinite Financial is that it improves your cash flow.

Dividend-paying entire life insurance is really reduced threat and uses you, the insurance holder, a wonderful deal of control. The control that Infinite Financial provides can best be organized into 2 categories: tax advantages and asset securities.

Infinite Banking With Whole Life Insurance

When you use whole life insurance policy for Infinite Financial, you participate in an exclusive contract between you and your insurer. This personal privacy provides specific possession defenses not discovered in other monetary vehicles. Although these defenses may vary from one state to another, they can include protection from asset searches and seizures, security from reasonings and defense from creditors.

Whole life insurance policy policies are non-correlated properties. This is why they work so well as the financial foundation of Infinite Banking. No matter what happens on the market (supply, realty, or otherwise), your insurance coverage preserves its well worth. Way too many individuals are missing this vital volatility barrier that aids shield and expand wide range, instead breaking their money right into two containers: checking account and financial investments.

Whole life insurance policy is that third container. Not only is the rate of return on your whole life insurance plan ensured, your fatality benefit and costs are likewise ensured.

This framework lines up flawlessly with the concepts of the Continuous Wealth Method. Infinite Banking attract those looking for higher economic control. Right here are its main benefits: Liquidity and access: Plan financings offer prompt access to funds without the limitations of typical bank car loans. Tax obligation performance: The cash money worth expands tax-deferred, and policy loans are tax-free, making it a tax-efficient device for developing wealth.

Bank On Yourself Plan

Property defense: In several states, the money worth of life insurance policy is protected from creditors, adding an extra layer of monetary protection. While Infinite Banking has its qualities, it isn't a one-size-fits-all service, and it features significant drawbacks. Here's why it might not be the very best method: Infinite Financial often calls for detailed plan structuring, which can perplex policyholders.

Picture never ever having to fret about small business loan or high rates of interest again. What if you could obtain cash on your terms and construct wealth all at once? That's the power of boundless financial life insurance policy. By leveraging the cash money worth of entire life insurance coverage IUL policies, you can expand your wealth and obtain money without depending on typical financial institutions.

There's no collection lending term, and you have the flexibility to choose the payment schedule, which can be as leisurely as settling the financing at the time of fatality. This versatility encompasses the servicing of the lendings, where you can select interest-only payments, keeping the loan equilibrium level and convenient.

Holding money in an IUL repaired account being credited rate of interest can commonly be far better than holding the cash on down payment at a bank.: You have actually constantly desired for opening your own bakeshop. You can borrow from your IUL plan to cover the first costs of renting a space, buying tools, and employing team.

Infinite Banking Strategy

Personal fundings can be acquired from traditional banks and credit scores unions. Borrowing money on a credit score card is typically very pricey with yearly percentage prices of passion (APR) usually reaching 20% to 30% or more a year.

The tax treatment of policy loans can differ considerably relying on your nation of house and the particular terms of your IUL plan. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan loans are normally tax-free, supplying a substantial benefit. In other territories, there might be tax effects to consider, such as possible tax obligations on the car loan.

Term life insurance policy only gives a fatality benefit, without any kind of cash money worth build-up. This implies there's no money value to obtain against. This short article is authored by Carlton Crabbe, President of Funding forever, a professional in offering indexed universal life insurance policy accounts. The information given in this post is for academic and informational objectives just and need to not be understood as financial or investment advice.

For financing policemans, the considerable guidelines enforced by the CFPB can be seen as troublesome and limiting. Initially, car loan police officers commonly say that the CFPB's laws create unneeded bureaucracy, bring about more paperwork and slower car loan handling. Regulations like the TILA-RESPA Integrated Disclosure (TRID) regulation and the Ability-to-Repay (ATR) needs, while targeted at protecting consumers, can lead to hold-ups in closing deals and raised operational expenses.

Latest Posts

'Be Your Own Bank' Mantra More Relevant Than Ever

My Own Bank

Become Your Own Banker Whole Life Insurance